As ecommerce and online transactions increasingly dominate sales for many firms, PayPal has announced support for even more payment methods in an effort to guide people through the checkout easily and speedily.

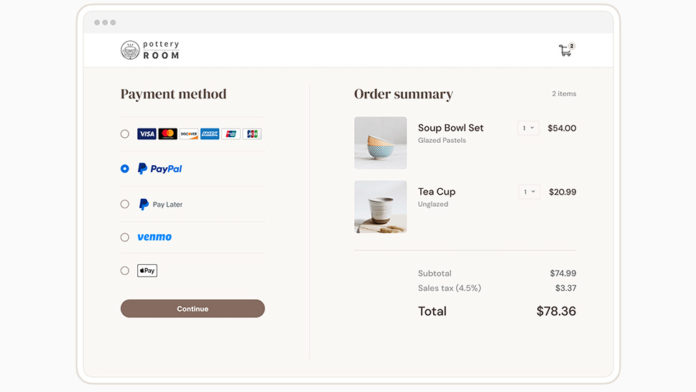

Going forward, along with the existing PayPal payment methods (including PayPal, Venmo, Pay Later, and Checkout with Crypto) and regular card payments, the checkout service has added support for Apple Pay.

This is in response to a Ponemon Institute study that found more than half (59%) of customers abandon their shopping cart when their preferred payment method isn’t present.

Checkout with PayPal

Along with Apple Pay, PayPal has also introduced a feature designed to save manual card entries in a secure vault so that future payments can be carried out more quickly.

For those times when you’ve lost a card or it has simply expired, and you’re issued with an entirely new card number, a real-time account updater should be able to handle changes automatically.

The shopping cart software provider hopes that offering such a comprehensive set of payment methods will help SMBs to be more competitive without the need for expensive and complicated systems.

“The retail landscape is constantly evolving and SMBs need access to a range of tools to help them drive sales, cut costs and protect themselves and their customers from fraud,” PayPal Merchant Experiences and Payment Solutions VP Nitin Prabhu said.

Offloading some of the payment processes onto PayPal will also allow companies to remain PCI compliant without needing to think about it too much, while flat-rate or IC++ pricing helps to provide more transparency.

The cost for this is a 49-cent fee and 2.59% of each transaction for card and alternative payment methods including digital wallets, raising to 3.49% plus 49 cents for PayPal payments.

Source: www.techradar.com